property tax assistance program illinois

Available here The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. Own and occupy a property.

Property Tax Village Of Carol Stream Il

Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed until October 1.

. Homeowners with household incomes less than 150 of the Area Median Income. The COVID-19 vaccines are safe and effective and are an important tool for ending the global pandemic. Check Your Eligibility Today.

The Detroit Tax Relief Fund is a new assistance program that will completely eliminate delinquent property taxes owed to the Wayne County Treasurers Office for Detroit homeowners who have received the Homeowners Property Exemption HOPE and the Pay As You Stay PAYS programCall 313244-0274 or visit the website to apply for financial assistance today. Most states provide low income families with free advice as part of the federal government funded Legal Services Corporation LSC. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Their next payment is due June 1. And there is no money to pay it said Karpf. The Karpfs pay 10000 a year in property taxes.

The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a financial hardship caused by the COVID-19 pandemic. Aand information on financial assistance programs for elderly Illinois residents is available here. Check If You Qualify For 3708 StimuIus Check.

This is a fairly large discount and can help people save a. Mortgage Relief Program is Giving 3708 Back to Homeowners. It will cover up to 30000 in overdue mortgage payments taxes and fees.

Senior Citizens Real Estate Tax Deferral Program This program allows persons 65 years of age and older to defer all or part of the real estate taxes and special assessments up to a maximum of 5000 on their principal residences. Accessibility improvements may include. Search for jobs related to Property tax assistance program illinois or hire on the worlds largest freelancing marketplace with 21m jobs.

The Karpfs pay 10000 a year in property taxes. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call. Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas.

You may be eligible to receive financial assistance for the following. Navigation of the application was discussed. 2 The amount of tax relief is relatively minor.

The discussion will focus on simplified procedures for utilizing the new Affordable Housing Special Assessment Program for property tax relief. May 17 2022. Tuesday February 15th.

Documents can be submitted after if needed. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. The program is administered.

The following is a list of programs offered by the State of Illinois to its senior citizens. The Illinois Department of Revenue does not administer property tax. Your household income from all sources for the prior year must be below 55000.

The Illinois Homeowner Assistance Fund ILHAF or HAF program opened on April 11 2022. Property taxes are due in June and September. The Illinois Housing Development Authority IHDA runs the program.

Pritzker budget proposal aims to ease pinch of inflation with 1 billion in tax relief The Democratic governors office says the state will provide relief in grocery stores at the gas pump and on property taxes. 31 rows Purpose of the Property Tax Relief Program. It will be open until 1159 PM on May 31 2022.

27610 for a household of one. Your household income from all sources for the prior year must be below 55000. Senior Citizens and Disabled Persons Property Tax Relief and Pharmaceutical Assistance The Circuit Breaker Program -Provides property tax relief and pharmaceutical assistance to.

The Illinois Emergency Homeowner Assistance Fund ILHAF program is now OPEN. Dont Miss Your Chance. Senior citizen tax deferral There is also a loan program to help homeowners who are 65 by June 1 of the relevant tax year.

Districts must apply annually if they wish to be considered for the future grant cycles. A lawyer may be able to help a homeowner enter into a payment program. Illinois homeowners experiencing financial hardship associated with the COVID-19 pandemic can apply for a housing assistance grant of up to 30000 starting in April.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Over 60 years old. It is managed by the local governments including cities counties and taxing districts.

If so you may qualify for a state loan of up 5000 to pay current property tax bills. Ramps grab bars widening doorways and other improvements to enhance the independence of individuals with disabilities. Its free to sign up and bid on jobs.

Vaccines protect you and. Created by the American Rescue Plan Act ILHAF is designed to prevent. The Property Tax Relief Grant PTRG is a one year grant program.

A new law in the Property Tax Code 35 ILCS 20010-23 will provide a property tax break to veterans and persons with disabilities who make accessibility improvements to their residences. Ad 2022 Latest Homeowners Relief Program. The program requirements include.

Eligible households may now apply for up to 30000 in free assistance to pay past due mortgage payments property taxes property insurance and delinquent homeowner andor condo association fees. CAAs may partner with local governments community-based organizations and the private sector to provide services. The largest package floated would send homeowners direct rebates of up to 300 on their property tax bills.

If you are a taxpayer and would like more information or forms please contact your local county officials. This webinar is intended for property owners whose properties are located in Cook County and arewere in the countys Class 9 program. However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years.

Check If You Qualify For This Homeowner StimuIus Fast Easy. Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney. If you apply and are qualified for this property tax program it will.

A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax bills. Freeze your home assessed. Senior Citizens Property Tax AssistanceSenior Freeze.

Property tax assistance program illinois Wednesday April 13 2022 Edit. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Will my Property Tax Relief Grant PTRG be added to my Base Funding Minimum. You may qualify for a senior freeze if you are. Illinois Homeowner Assistance Fund ILHAF The Illinois Homeowner Assistance Fund Program provides direct financial assistance to prevent mortgage delinquencies defaults displacements and foreclosures for income-eligible homeowners experiencing pandemic-related hardships.

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Property Tax Homestead Exemptions Itep

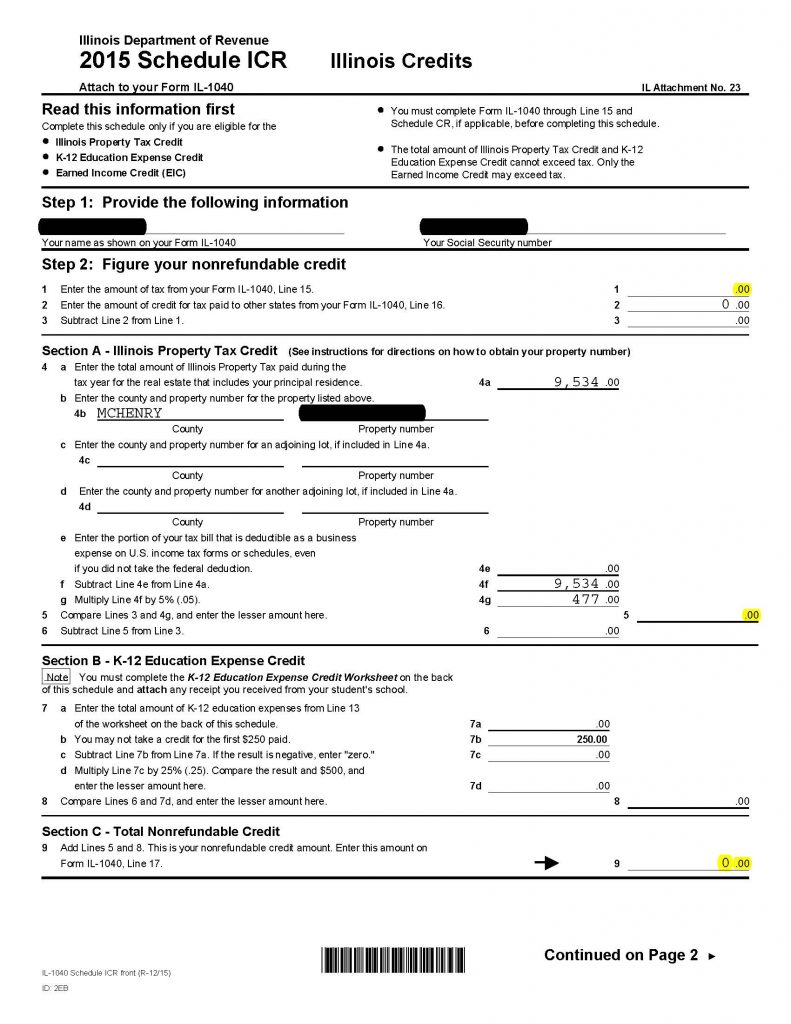

Deducting Property Taxes H R Block

Property Taxes By State In 2022 A Complete Rundown

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Illinois Property Tax Exemptions What S Available Credit Karma Tax

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Sen Wilcox To Serve On Property Tax Relief Task Force Craig Wilcox

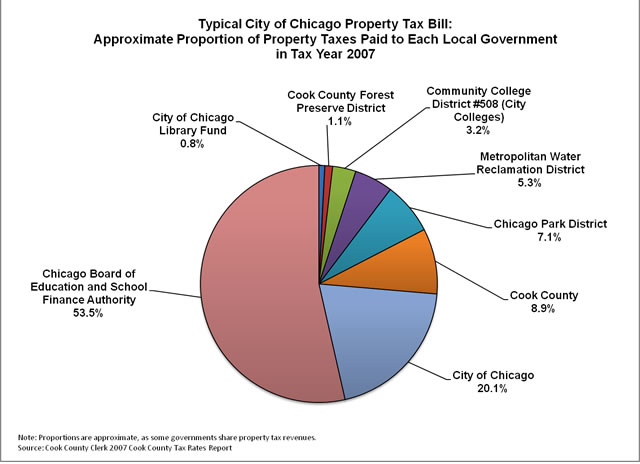

Where Do Your Property Tax Dollars Go The Civic Federation

Cook County Property Tax Bill How To Read Kensington Chicago

Property Tax Comparison By State For Cross State Businesses

Providing Some Property Tax Relief For Low Income Seniors

Property Tax City Of Decatur Il

About The Cook County Assessor S Office Cook County Assessor S Office

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)