tax benefits of retiring in nevada

If youre looking for a tax-friendly retirement Nevada is one of the places to be. No State Income Tax.

2022 S Best U S States To Retire In Personal Capital

No tax on sale or transfer of shares which keeps more cash in your pocket.

. Get tips for choosing the best place to retire for your lifestyle in 99 Retirement Tips. 10 above the national average PER CAPITA INCOME FOR POPULATION. Nevada is one of only a few states that does not impose an income tax and that includes income from Social Security and retirement accounts.

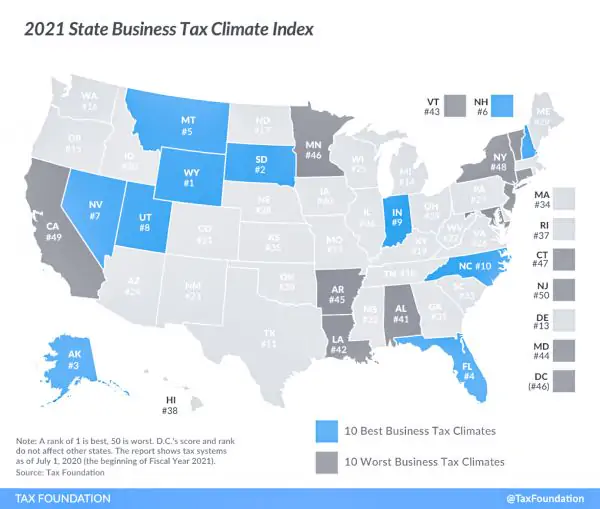

Nevada is a low-tax paradise. Nevada corporations may purchase hold sell or transfer shares of its own stock. States With No Income Tax Eight states dont impose an income tax on earned income as of 2021.

Retiring in Reno Nevada gives you access to gambling as well as activities like skiing golfing or just hanging out on Lake Tahoe. No requirements of shareholders directors to live in Nevada. Zero No Nevada State Income Tax.

Withdrawals from retirement accounts and public and private pension income are also not taxed whatsoever. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. To schedule an appointment please call Member Services at 775-684-7000 or 702-486-3100.

In fact the state has no taxes on income or Social Security benefits. Appointments are available only on Thursdays. Nevadas tax benefits are great for families businesses and retirees.

Specific Nevada Tax Benefits. No Corporate Income Tax. No tax on issuance of corporate shares keeps more cash in your pocket.

The housing market in Nevada was hard-hit in 2007. Social Security and Retirement Exemptions. No Taxes on Corporate Shares.

Youll Likely Pay Less in Taxes. Nevada offers an abundance of tax advantages for relocating home and business owners alike including. Not only does Nevada have relaxed gambling laws but also some of the best tax benefits for retirees.

Retirees over 65 that are anchored to the PEBP Consumer Driven Health Plan PPO Low Deductible Plan PPO Premier Plan EPO or. No personal income tax. Top Reasons to Incorporate in Nevada.

Residents of Nevada are not assessed a state income tax. Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most. Retiring After Age 65.

76 of seniors who retire in Las Vegas report good health. Overview of Nevada Retirement Tax Friendliness. It also has relatively low property taxes while the state sales tax is somewhat higher than average.

Lower cost of living. In the top 10 of states according to data from NOAA. The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax.

No succession or inheritance with IRS which keeps more cash in the pockets of your successors andor heirs. A retirement in Nevada makes a lot of financial sense for many individuals. Additionally Social Security income is not taxed as well as withdrawals from retirement accounts.

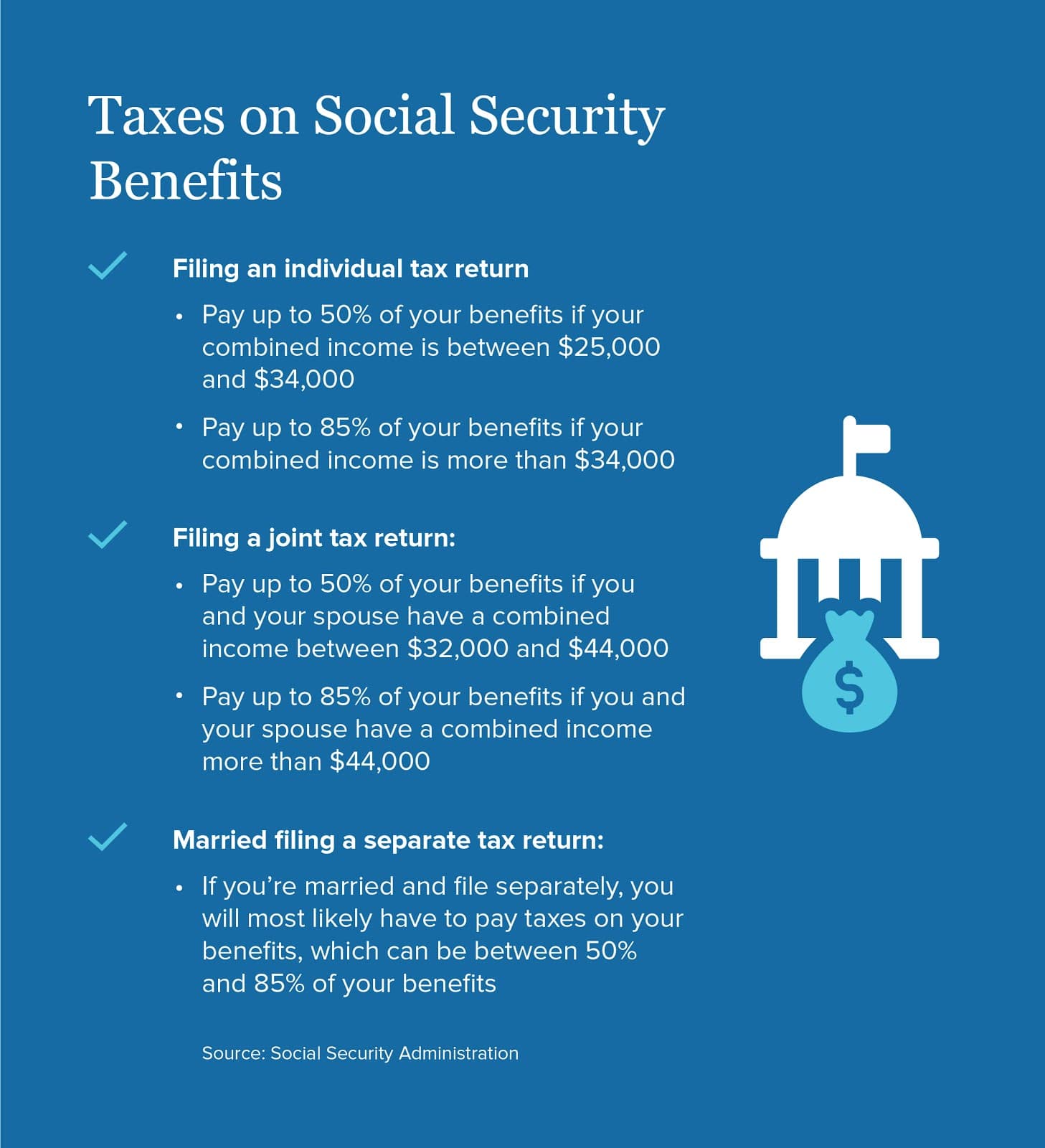

Ad Get tips on choosing where to spend your retirement many more in 99 Retirement Tips. If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. They are not taxed.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. Nevada has far more sunny days and lower humidity to enjoy them than most states. 1 day agoHi Matt Since you turned 62 after January 1 2022 you wont receive the upcoming 59 cost of living COLA increase no matter when you start drawing your Social Security retirement benefits.

No Personal Income Tax. Nominal Annual Fees. 194 COST OF LIVING FOR RETIREES.

No gross receipts tax. 5 Good Reasons to Retire in Nevada 1. Considering the national average is 100 retirement here is going to cost more than some other states.

33238 TAX RATING FOR RETIREES. According to Zillow the median home value in Nevada is 291800 While that may still. 10th highest income for seniors in Las Vegas.

To figure out your provisional income begin with your adjusted gross income and then add 50 of your Social Security benefit and all of your tax-exempt interest. 1 How To Spend A Day In Scottsdale Az Arizona Road Trip Great Basin National Park Trip. Social security income and retirement account income are not taxed.

The Most Tax Friendly States For Retirees Vision Retirement Nevada Tax Advantages And Benefits Retirebetternow Com. Please note that our office is located in Carson City. Ad Our Resources Can Help You Decide Between Taxable Vs.

However prescription medications and consumable grocery items are exempt. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

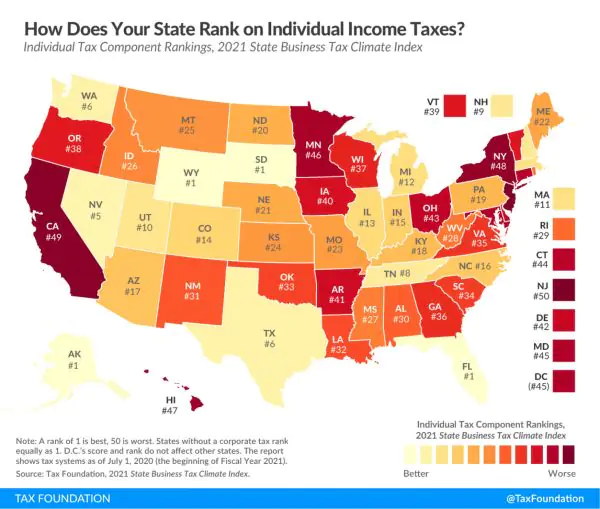

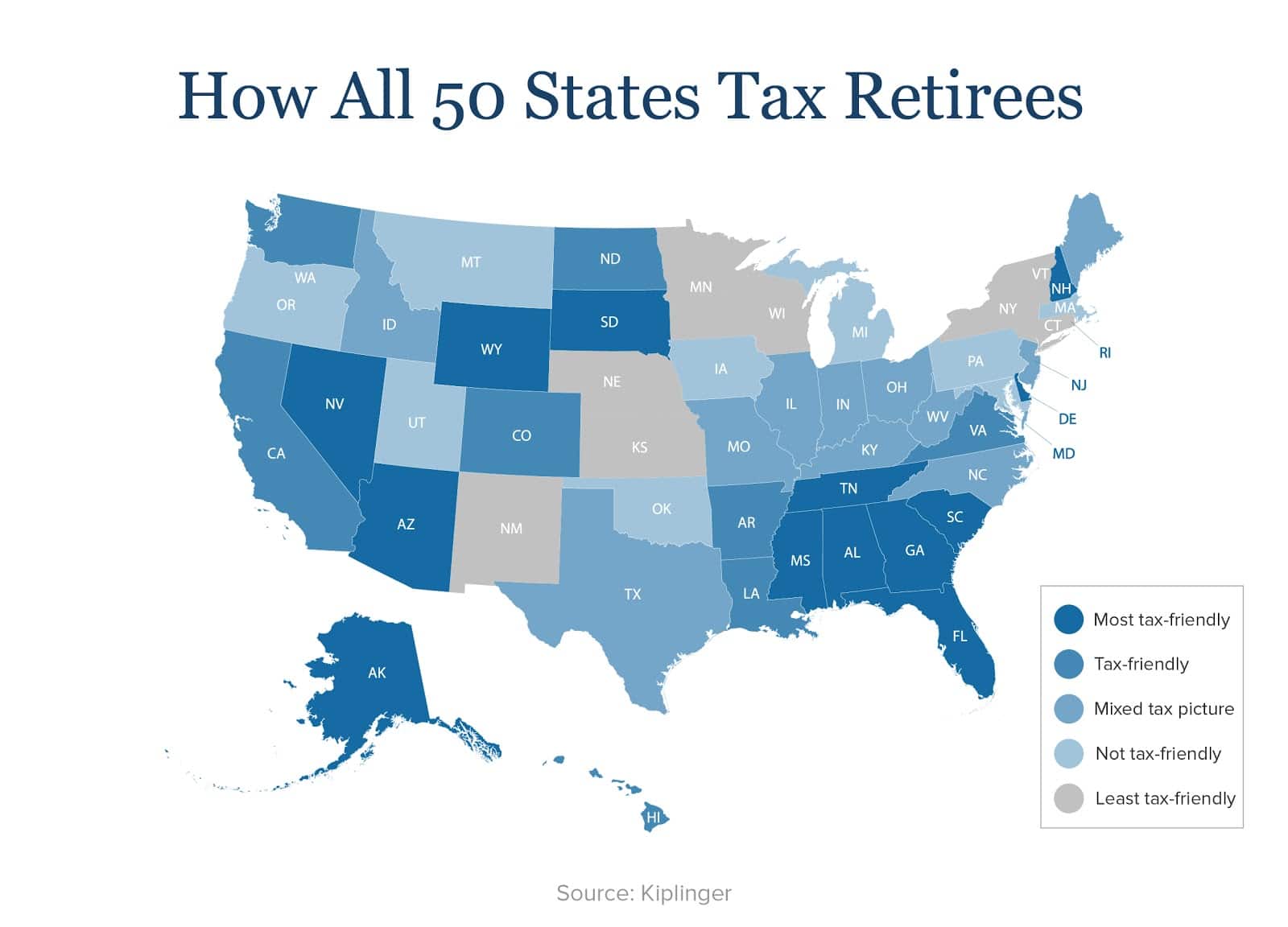

Nevada has no state income tax which means all retirement income is tax-free at the state level. The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire.

State sales tax is 685 but localities can increase that to 81. No Nevada Inheritance Tax after 3 years of residency. 320189 SHARE OF POPULATION 65.

At 83 Total tax burden in Nevada is 43rd highest in the US. The state does not have estate or inheritance taxes either. Tax benefits of retiring in nevada Saturday June 11 2022 Edit.

No Franchise Tax. Nevada corporations may issue stock for capital services personal property. According to Sperlings Best Places the cost of living index in Nevada is 102.

Nevada has no income tax. Low Cost of Living. Marginal Income Tax Rates.

The current state sales tax is 685 percent with an additional 125 percent assessed by counties. No corporate income tax. The statistics show that more people are retiring in Las Vegas and that it is beneficial to them.

If your provisional income is less than 25000 for individual filers or. Theres No Corporate Income.

Nevada Retirement Tax Friendliness Smartasset

How To Plan For Taxes In Retirement Goodlife Home Loans

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

7 Pros And Cons Of Retiring In Nevada 202 Aging Greatly

Nevada Retirement Tax Friendliness Smartasset

Nevada Tax Advantages And Benefits Retirebetternow Com

States That Don T Tax Retirement Income Personal Capital

Nevada Retirement Tax Friendliness Smartasset

How To Plan For Taxes In Retirement Goodlife Home Loans

How To Plan For Taxes In Retirement Goodlife Home Loans

37 States That Don T Tax Social Security Benefits The Motley Fool

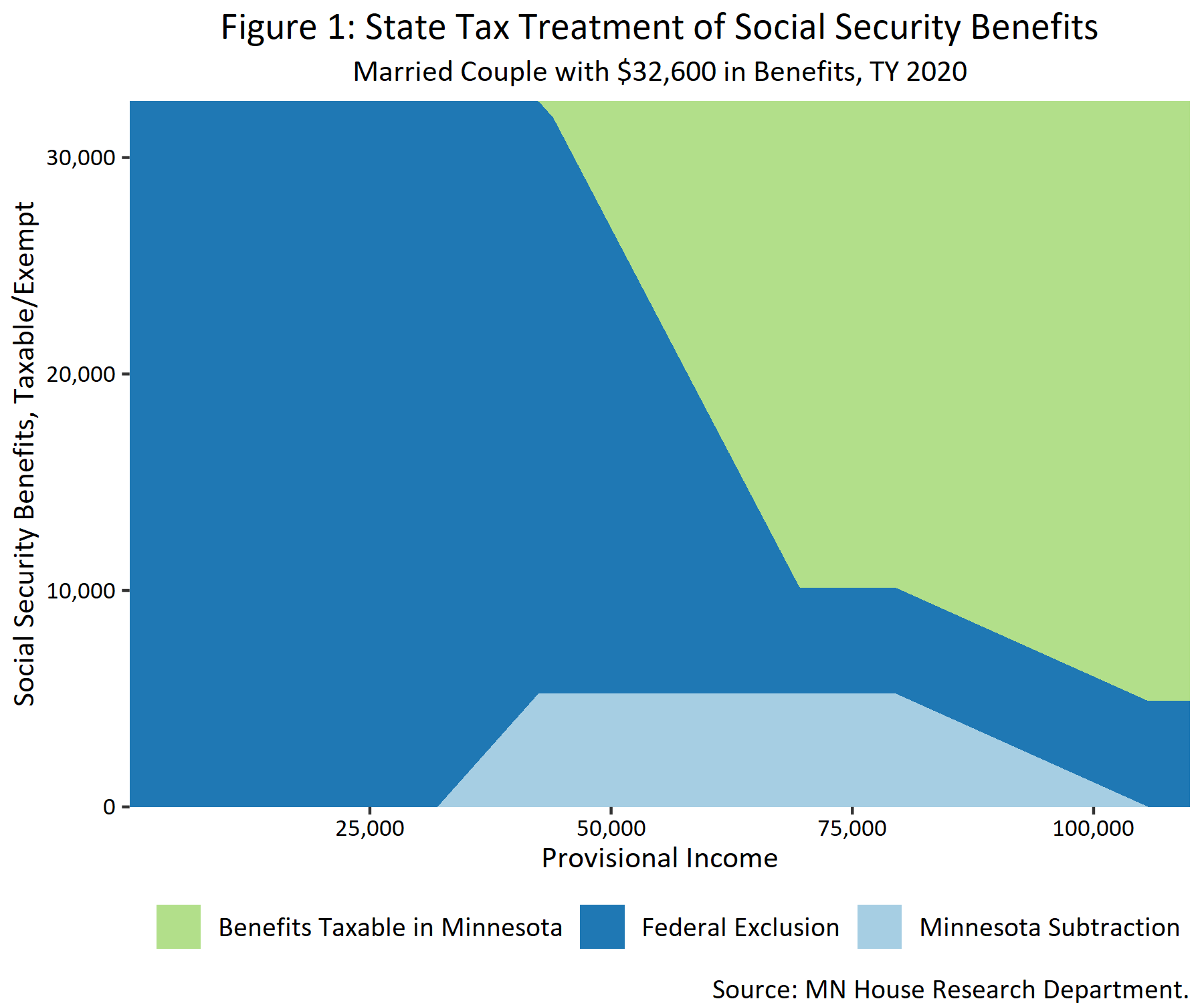

Taxation Of Social Security Benefits Mn House Research

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

37 States That Don T Tax Social Security Benefits The Motley Fool

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc